On September 1, the Chinese Enterprise Association, China Entrepreneur Association released the 2019 China Enterprise 500 list, a total of 265 state-owned enterprises, 235 private enterprises, China Petrochemical, China Petroleum, State Ground Package The Ping An Group first crowded into the "trillion club". In terms of profitability, workers and farmers build 10 "four major lines", Ping An Group, Alibaba, Tencent, and other enterprises in the top 10 positives.

2019 China Enterprise is 500, China Petrochemical is ranked first in revenue of 274.278 billion yuan.

The list of the list is the threshold for 17 years

According to data, China Enterprise 500 is from the China Enterprise Federation, and the Chinese Entrepreneur Association shall be organized by international conventions, published in the Chinese companies list. Since 2002, the annual annual list of China Enterprises will be announced every year, which is 500 China companies in China.

Business income is the main indicator of the list of list. The data shows that the total number of operating income in the finalists this year is 79.1 million yuan, an increase of 11.14% over the previous year. At the same time, the threshold of the 2019 China Enterprise 500 has been raised to 32.325 billion yuan, and the threshold of the finalist has been improved in 17 consecutive years. The list shows that China Oriental Electric Group Co., Ltd. from Sichuan is 32.325 billion yuan, the last bit of the list.

It is worth noting that the level of receiving the head large company is further enhanced. Among them, "100 billion clubs" is more large, and the business income of 194 enterprises in China's 500 companies exceeds 100 billion yuan. Specifically, the top five of the list is China Petrochemical Group Co., Ltd., China Petroleum Group Co., Ltd., State Grid Co., Ltd., China Construction Co., Ltd. and Industrial and Commercial Bank Co., Ltd., corresponding operating income of 274.278 billion Yuan, 25.99417 billion yuan, 2560.254 billion yuan, 119.325 billion yuan and 116.6411 billion yuan, and have different degrees in the previous year's list.

Then, the sixth China Ping An Insurance (Group) Co., Ltd. has not changed, but the business income is from 974.57 billion yuan in the previous year, rising to 108.2146 billion yuan, officially entered the "trillion" club".

Other Star Enterprises, 2019 China Enterprise 500, Alibaba Group Holdings Co., Ltd. ranked 45th in business income with 37.684 billion yuan, ranking 69th in the last year. Tencent Holdings Co., Ltd. ranked 60 in business income of 312.694 billion yuan, and lifted from the 75th place in the previous year. Huawei Investment Holdings Co., Ltd. ranked 15th in this list, corresponding business income is 7212.2 billion yuan, a list of last year, ranking a bit, revenue over 100 billion yuan.

Four big lines, Ali, Tencent, etc.

In addition to business income, the list also combed the profitability of the finalists. Data show that 2019 China Enterprise 500 finalists achieved total profits of 4486.425 billion yuan, an increase of 20.7% over the previous year; net profit attributable to parent company reached 353.5 billion yuan, year-on year year increased by 10.3%.

Among them, the top ten companies in the net profit data are China Industrial and Commercial Bank Co., Ltd., China Construction Bank Co., Ltd., China Agricultural Bank Co., Ltd., China Banking Co., Ltd., China Development Bank Co., Ltd., China Ping An Insurance ( Group) Co., Ltd., Alibaba Group Holdings Limited, China Merchants Bank Co., Ltd., Tencent Holdings Co., Ltd., China Mobile Communications Group Co., Ltd.

Specifically, workers, agriculture, China, and build four major lines of net profit lists, corresponding net profits are 297.676 billion yuan, 202.783 billion yuan, 180.886 billion yuan, 254.65 billion yuan, total net profit of 9360 100 million yuan. The other two financial institutions National Development Bank Co., Ltd., China Ping An Insurance (Group) Co., Ltd. corresponding to net profit is 11.0758 billion yuan, 10.744 billion yuan.

According to the statistics of the list, the net asset profit margin of China Enterprises in 2019 is 9.7%, which is 0.2 percentage points over the previous year. Among them, non-silver corporate profitability is also continuous improvement. 481 non-silver enterprises's income profit margins were 2.86%, 8.34%, respectively, and increased by 0.07 percentage points, 2.46 percentage points, respectively, two consecutive years.

Entity enterprise net asset profit margin improvement

In addition, CCTV network reported that 2019 China Enterprise 500 report shows that the 500-strong profit margin index of China Enterprises has a reduction, of which the net assets of the entity enterprise is 8.34%, which has increased by 2.47 percentage points; the net asset profit margin of bank net assets is 12.38%, reduced by 0.48 percentage points, one liter, and the gap between the net assets of the entity and banks is further reduced.

For this change, Zhao Xijun, Vice President, Vice President of Renmin University of Renmin University, believes that first, the net asset profit margin of the entity economy and the net assets of the banking industry are shrinking, this trend should be the overall economic development, efficiency A manifestation of improvement. Secondly, Zhao Xijun also mentioned that from the perspective of accounting and accounting, the high profit rate is affected by many factors. Some companies will do a variety of operations that meet the accounting policies, and make the profit margin more reasonably as much as possible, sometimes through cost-sharing or profitable smoothing, this is some month or some time periods The profits are not necessarily true profits. For example, banks find that the regulatory authorities require more strict, banks may increase their consumption, and will impact profits.

"From this perspective, you can't absolutely superstitious profit data, but also through profits, seeing each company, financial institutions have done other processing during the formation of profits, such as bank verification. If There are a lot of money, indicating that it is earning money, but it is necessary to take the money to go to the previous bad loan, make up for the previous problems. From the current situation, commercial banks are increasing bad asset disposal and verification. Strength, put the money to the earnings of the past, so the net assets profit margin is not as fast as before. "Zhao Xijun said.

Huawei patent leading lead

In the past year, the policy level has introduced some taxation encouragement policies for R & D innovation. On May 3, 2018, Deputy Minister of the Ministry of Finance said that April 25, the State Council's executive meeting decided to concentrate on 7 tax policies. Overall, these seven policies focus focuse with two aspects, promote expanding employment and encourage technological innovation. In the encouragement of scientific and technological innovation, Cheng Lihua said that my country has gradually formed a tax-selling policy system to support high-tech R & D and industrialization, covering multiple innovation links, coverage, wide and popular Guiding. This time we are more accurately asking, opening a key link, and better promotes innovation. For example, the loss of the loss of high-tech enterprises and technology-based SMEs is prolonged to 10 years from 5 years, and the loss of the initial accumulation of innovative enterprises cannot be fully compensated. Cancel the restrictions of deducting deductions must not be applied to the deduction of overseas research and development costs, and the implementation of overseas research and development costs can also enjoy the addition.

Under the promotion of policies, the research and development of large-scale enterprises in China has also increased. 2019 China Enterprise 500 list statistics, 426 companies that fill in the data were investing in R & D costs 976.548 billion yuan, with their own hosae ratio, a substantial increase of 21.71%. The average R & D intensity of 426 companies increased to 1.60%, an increase of 0.04 percentage points.

In addition, 340 enterprises declared participation in standard development, participated in 1905 international standards, increased by 350 in the previous year, and growth in two consecutive years. Among them, the telecommunications service industry participates in international standards is the most prominent.

In 2019, China's top 500 patented patents, the invention patent is 36.61%, which increased by 0.45 percentage points from the previous year, and the proportion of inventive patents has been improved for 6 consecutive years, and the patent quality is steadily improved. Huawei continues to stay in the patent quantity and the number of invention patents. Read the full article, original text title: [Group chat] joined this circle, experience the different work

Article Source: [Micro Signal: Gkongbbs, WeChat public number: Industrial Control Forum] Welcome to add attention! Please indicate the source of the article.

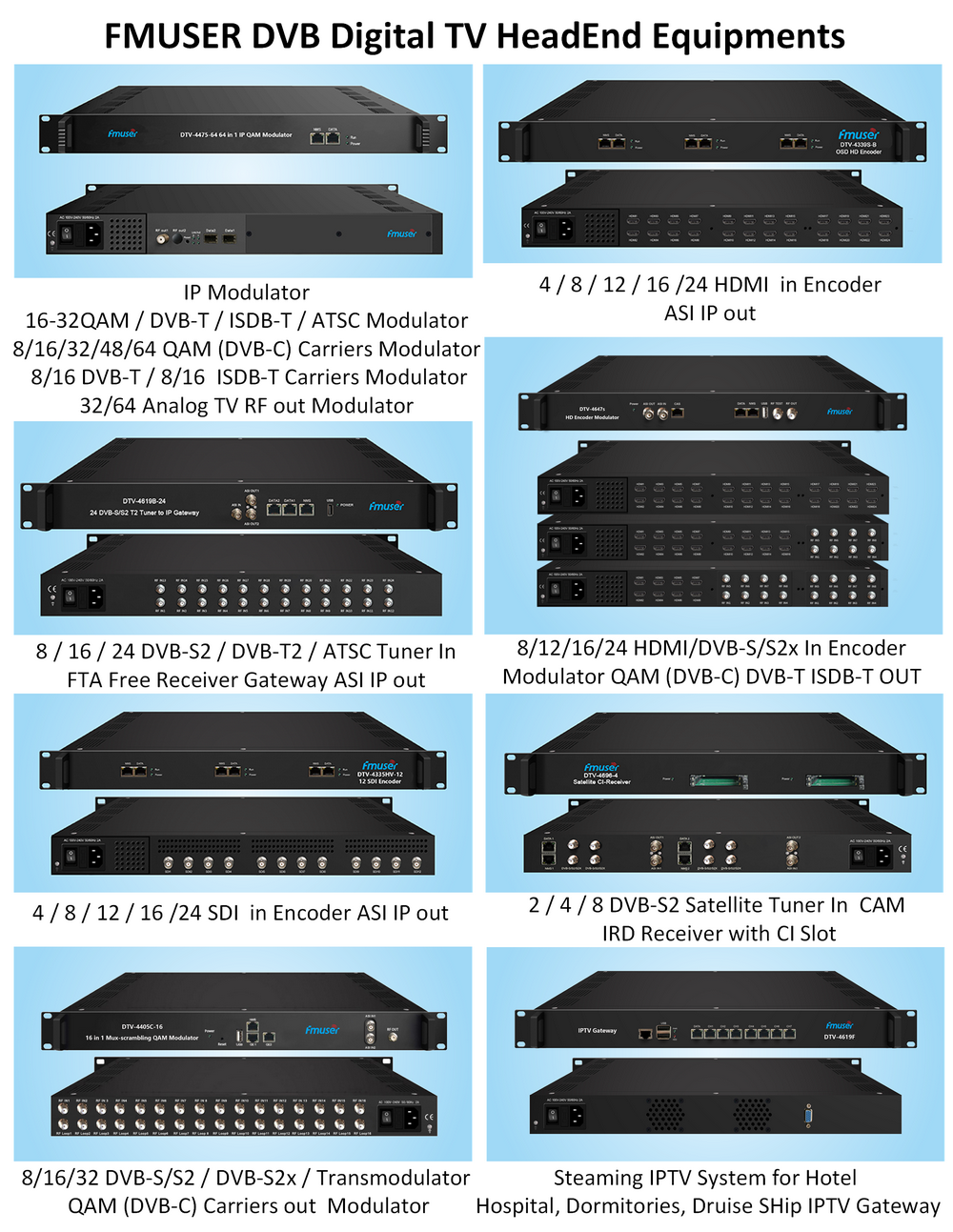

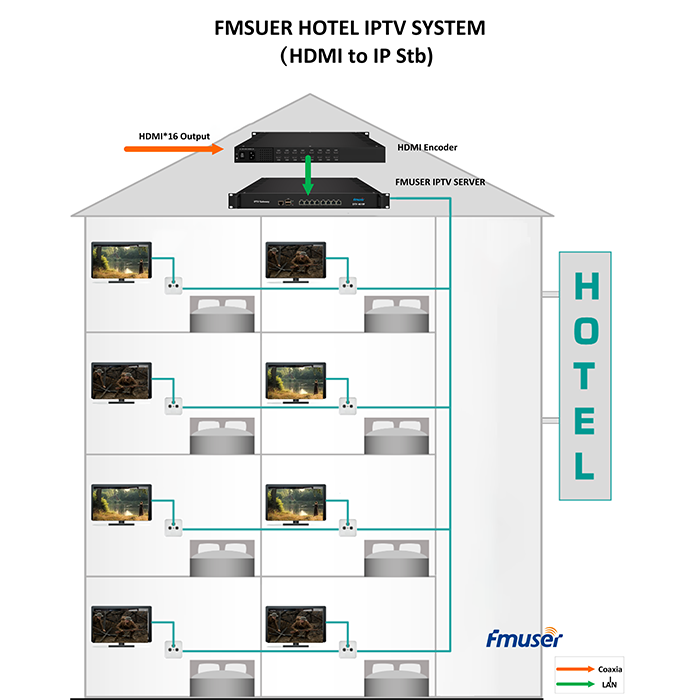

Our other product: