"According to the financial statements for the first half of 2016 released in September by Abu Dhabi advanced technology investment company (atic), now Mubadala development company, the United Arab Emirates, its semiconductor technology division (mainly global foundries) had a net loss of US $1.35 billion, a significant increase of 67% over the first half of 2015, A loss of $1.3 billion for the whole year.

As the second largest foundry in 2015, the current performance of global foundries is undoubtedly disappointing. Global foundries is not advancing but retreating in an environment where global Fabs are benefiting from the IC industry, especially the rapid development of China's IC industry. Let's review the development process of global foundries in recent years to see what it has experienced since its separation from AMD.

History of global foundries

Global foundries used to be AMD's wafer department. In 2008, Ruiz, then AMD's CEO, sold AMD's own wafer factory to atic in Abu Dhabi.

After the transaction involving US $8.4 billion, AMD will hand over all existing chip manufacturing equipment to the new company, including two wafer factories and related assets in Dresden, Germany, intellectual property rights, and the planned New York State wafer factory, with a total value of about US $2.4 billion. Meanwhile, AMD's existing debt of about $1.2 billion will also be borne by the new company. At the beginning of its establishment, the new company mainly undertakes the manufacturing of AMD processors and graphics chips, and then will undertake outsourcing orders from other semiconductor enterprises.

On March 2, 2009, a new wafer factory, global foundries, was established.

On January 13, 2010, Globalfoundries acquired Singapore licensed semiconductor.

In 2013, capital expenditure was about 4 billion 500 million US dollars, and the number of customers imported into 28 nanometer processes reached 12, including Rockchip and mobile phone chip factory in Chinese mainland.

In 2013, the proportion of revenue of each process was 56% below 45 nm, 19% below 55 / 65 nm, 19% below 90 nm and 0.18 micron, and 6% below 0.18 micron.

By the first half of 2014, the 8-inch wafer factory was full of orders. The company was optimistic about the industrial boom and decided to upgrade its six factories in Singapore from 8-inch factory to 12-inch wafer factory. The source of equipment was the purchase of 12 inch machine equipment of maode Zhongke in DRAM factory in 2013. It is estimated that 60% of the production capacity is 12 inches and 40 nm production capacity is 8 inches. The annual production capacity of 12 inch and 8-inch factories in the plant is 1 million pieces and 300000 pieces respectively, The company plans to upgrade the process technology from 0.11 ~ 0.13 microns to 40 nanometers. Among them, 12 inches will be used in LCD driver IC, power management IC and other markets, and the capital expenditure will reach US $1 billion in recent two years.

On October 20, 2014, the company acquired IBM's global commercial semiconductor technology business, including its intellectual property rights, technicians and all technologies of microelectronics business. In addition, the company will also provide 22nm, 14nm and 10nm technologies to IBM in the next 10 years, mainly supplying power processors for IBM.

Since its establishment, the net profit margin of global foundries has always been negative. In the first half of 2016, it fell to the bottom, reaching - 54%. According to Gu Wenjun of xinmou research, huge R & D investment, expensive equipment and depreciation costs are snowballing for global foundries. After more than $20 billion, if you don't invest, all your previous efforts will be wasted; Reinvestment is still profitable. Global foundries has actually fallen into a vicious circle.

As the world's second largest foundry, as of June 30, 2016, global foundries had total assets of US $20.3 billion, total liabilities of US $4.3 billion and an equity liability ratio of about 27%, which makes people worry about the prospect of global foundries.

In the past few years, although global foundries ranked among the world's wafer factories, in fact, it gradually lagged behind its competitors in terms of manufacturing process, especially the gap between it and TSMC, which was the first. As a result, its competitive advantage in the market decreased more and more, so global foundries had to change.

Take over IBM manufacturing business and introduce new technology

In addition to attacking new technologies, global foundries, which has a backward process, has been seeking transactions in the past few years. In 2014, they took over IBM's semiconductor manufacturing business and obtained semiconductor design capability from IBM. In this transaction, IBM paid $1.5 billion to global foundries as a takeover fee.

For global foundries, winning IBM should not lie in its factories, but more importantly in the patents and technologies accumulated by IBM, which is conducive to promoting their process progress and keeping up with competitors.

Taking the current research and development of three-dimensional fin transistor (3d-finfet) as an example, we can see the research and development energy of IBM. In order to solve the leakage current problem of planar transistors in the past, a three-dimensional transistor structure, FinFET (called tri gate by Intel), has been developed. At present, Intel is still the leading manufacturer in the global competition for FinFET design and process technology development, and it is IBM that can compete with Intel so far.

The biggest difference in process technology between IBM and Intel is the use of silicon on insulator (SOI) substrate. Although the cost of SOI substrate is much higher than that of bulk substrate used by Intel, SOI can greatly reduce the process steps and reduce the operating voltage to achieve the production efficiency of low-power chips. It can be seen that IBM's R & D capability can not be underestimated. The comparison of FinFET transistor profiles between Intel and IBM is shown in Figure 1. At present, the two different substrates have their own advantages and disadvantages. Who can win still needs time and verification in the market.

Through this merger, global foundries will have the right to give priority to the results of the project jointly developed by IBM and the colleges of nanoscale science and Engineering (CNSE) in Albany, New York, USA. what is remarkable is the next generation lithography technology that IBM will jointly develop with CNSE.

In terms of technology integration between two different enterprises, the main source of global foundries 14 nm FinFET process technology is Samsung Electronics.

In fact, Globalfoundries originally planned to launch its own 14nm XM process at that time, but there was no following after the announcement. In the end, they directly chose Samsung's 14nm FinFET process to break through with the help of the latter's rich experience and mature process. In the future, the development direction of FinFET technology between IBM and global foundries should be towards supporting and integrating Samsung Electronics.

However, according to the report of analysts at the end of 2014, the 14 nm Fab of global foundries was not ready at that time, and the progress may be delayed by one or two quarters. Some equipment manufacturers speculate that problems such as finance or yield may be the main reason for delaying the progress.

In mid-2015, Globalfoundries has begun to mass produce chips for their customers using the 14nm FinFET (14lpe) process. Global foundries said that their 14 nm semiconductor capacity could be comparable to that of Samsung foundry. Jason gorss, a spokesman for Globalfoundries, said that their 14nm climbing mass production has been on track, and the production capacity can be equal to that of ally Samsung. Global foundries did not disclose how many wafers they can produce each month using the 14nm LPE process, but the company said that some important equipment for commercial production of the 14nm FinFET process has been installed.

That is, in 2015, global foundries surpassed liandian and climbed to the position of the second brother of wafer foundry.

But for global foundries, this is not enough, because according to media disclosure, it has been performing poorly since it was spun off from AMD in 2008, with a loss of $1.5 billion in 2014 and $900 million in 2013. Therefore, global foundries needs to change in many ways.

Attack fd-soi to achieve curve overtaking?

Together with Samsung, the 14nm FinFET has been fully adopted by amdcpu / GPU, and a five-year wafer supply contract has been signed with AMD to jointly develop the 7Nm process. The habitual thunder blowing global foundries is a little complacent recently. Next, it will enter the 12NM process, but it takes a special road: fd-soi (silicon on fully depleted insulating layer).

As we all know, at present, the semiconductor process has shifted from 2D transistors to 3D transistors. Intel, TSMC, Samsung and gf are all doing it.

On the other hand, although amd has been backward in technology, it has a unique secret, that is, SOI (silicon on insulating layer), which was carried out in cooperation with blue giant IBM in that year, which can improve the technology by half a generation, and its excellent performance is also obvious to all.

However, amd abandoned SOI after entering 32nm. However, after independence, GF has retained SOI technology and acquired relevant technologies of IBM. The latter's latest power8 is manufactured by 22nm SOI process.

GF has previously achieved 22nm fd-soi (22fdx) for the first time in the world. It claims that the performance and power consumption index is comparable to 22nm FinFET, but the manufacturing cost is equivalent to 28nmm. It is suitable for the Internet of things, mobile chips, RF RF, network chips, etc. it has won more than 50 customers and produced in the first quarter of 2017.

Now GF has announced a new 12nmfd-soi (12fdx) process, which is planned to be put into mass production in 2019.

GF said that the performance of the 12fdx process is equal to that of the 10nm FinFET, but the power consumption and cost are lower than that of the 16nm FinFET. Compared with the existing FinFET process, the performance is improved by 15%, the power consumption is reduced by 50%, and the mask cost is reduced by 40% compared with that of the 10nm FinFET!

It will also provide the broadest dynamic voltage in the industry, greatly improve the design flexibility through software control transistors, provide the highest performance at high load and higher energy efficiency at static state.

The process is also aimed at low-power platforms, including mobile computing, 5g interconnection, artificial intelligence, automatic driving, etc. Shanghai Institute of microelectronics, Chinese Academy of Sciences, NXP semiconductor, VeriSilicon semiconductor, ceatech, Soitec, etc. have participated in the cooperation.

GF is promoting the research and development of 12fdx process at Fab 1 wafer factory in Dresden, Germany. It is expected to complete the first batch of streamers in the first half of 2019 and put into mass production in that year.

In short, GF is now walking on two legs: in terms of low power consumption, it focuses on 22 / 12dfx, especially the latter can replace 10nm FinFET; High performance directly into 7Nm FinFET.

Grab China's IC dividend and build a wafer factory with Chongqing

In May this year, Chongqing signed a memorandum of understanding with global foundries, a world-famous integrated circuit enterprise. The two sides will jointly establish a joint venture in Chongqing to produce 300mm chips.

According to the plan, the project includes upgrading an existing semiconductor plant to a 12 inch wafer manufacturing plant using mature process technology at the global foundries Singapore plant. The joint venture will directly purchase modern and advanced equipment to save product launch time, and is expected to be put into operation in 2017.

It is reported that the Chongqing municipal government will provide land and existing plants, and global foundries will be responsible for technology upgrading. The existing plant will be upgraded from an 8-inch wafer plant to a 12 inch wafer plant. According to the news, the existing plant is an old plant sold by maode of Taiwan DRAM plant. Global foundries alleges that the production verification technology of Singapore plant will be adopted at that time. Officially, the plant is expected to be reopened and mass produced in 2017, but global foundries did not disclose the technical nodes and initial capacity of the new plant.

Although gf's progress in the Chinese market is relatively slow, it has at least taken an important step.

expectation

As a close partner of AMD, amd was able to compete with Intel, and its wafer factory contributed a lot. It seems that Globalfoundries has not been smooth recently, but according to the naked eye, global foundries has been increasing investment in capital and technology in recent years. Fd-soi has also made gratifying progress. Earlier, it announced to skip 10nm and attack 7Nm directly. Investment and cooperation in China have strengthened the determination of global foundries to rise again. As for the future performance, it remains to be verified by time.

Search "aiban.com" and pay more attention. You can master the latest development board, intelligent hardware, open source hardware, activities and other information every day. Recommend attention!

[wechat scanning can be followed directly]

Related reading:

An article interprets the Titan x graphics card. Why does it sell 9499“

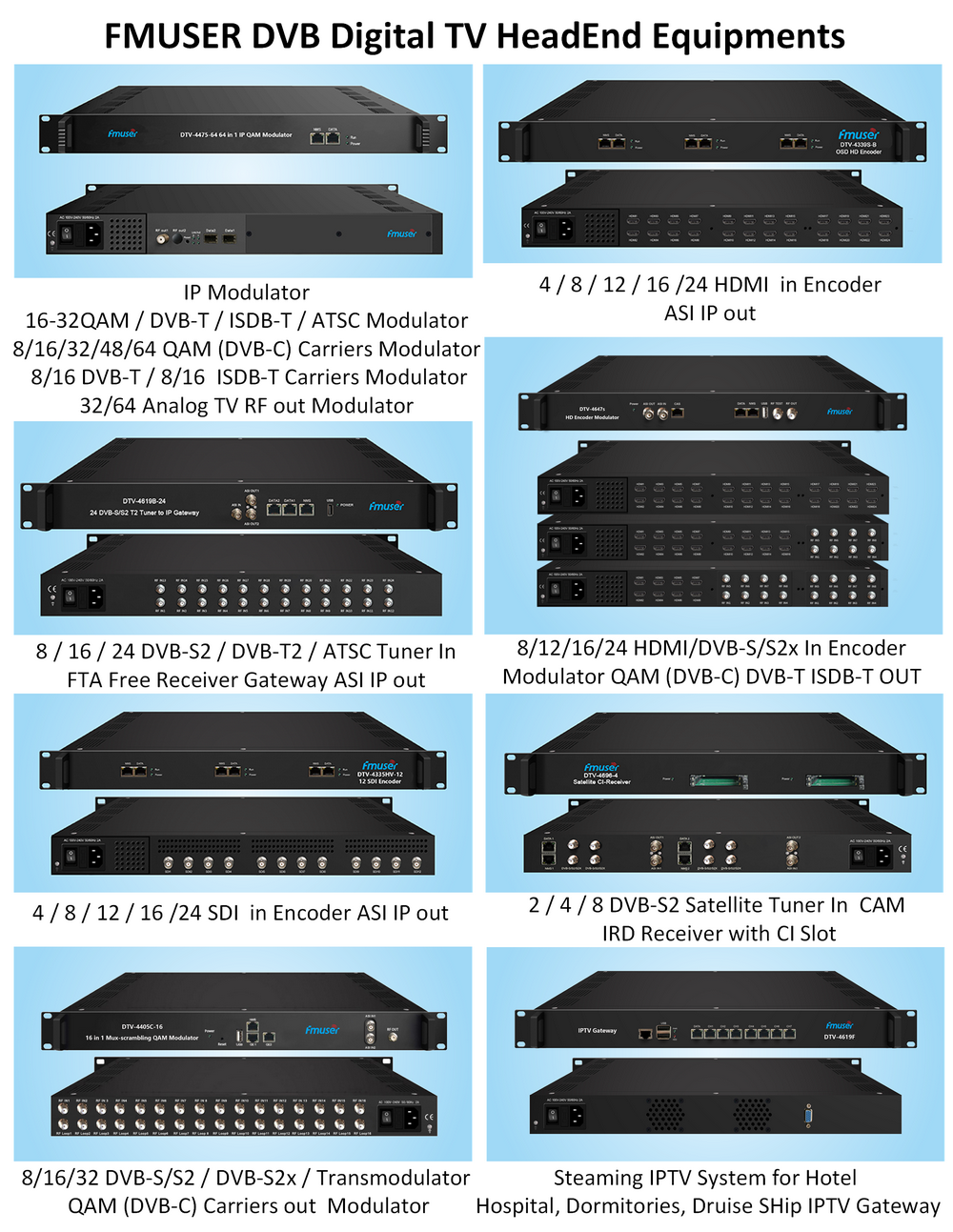

Our other product: